tennessee inheritance tax rate

IT-11 - Inheritance Tax Deductions. The top estate tax rate is 16 percent exemption.

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

It is one of 38 states with no estate tax.

. All inheritance are exempt in the State of Tennessee. Today the Tennessee inheritance tax exemption for 2014 is raised to 200000000. If the total Estate asset property cash etc.

Tennessee does not have an inheritance tax either. While there is no universal inheritance tax rate most states follow a progressive scale. Currently only six states require an.

No tax for decedents dying in 2016 and thereafter. There are NO Tennessee Inheritance Tax. All inheritance are exempt in the State of Tennessee.

Tennessee Taxpayer Access Point TNTAP Find a Revenue Form. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. IT-12 - Inheritance Tax Deduction - Real Property Sale Expenses.

Until this estate tax is. Consent to Online Transfer. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. The estate of a non-resident of Tennessee would not receive the full exemption. Next year it will.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State. No estate or inheritance tax. For deaths occurring in 2016 or later.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. Up to 25 cash back Update. There are NO Tennessee Inheritance Tax.

Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015. All inheritance are exempt in the State of. Inheritance taxes in Tennessee.

It is important to note that a higher rate of tax means a larger estate which means that. The net estate is the fair market value of all. Tennessee and Federal Estate Tax Exemptions Raised Today for 2014.

The inheritance tax is due nine months after death of the decedent. Tennessee Estate and Inheritance Taxes. Due Date and Tax Rates.

The top estate tax rate is 16 percent exemption threshold. If the total Estate asset property cash etc is over 5430000 it is subject to. Tennessee does not have an estate tax.

The net estate less the applicable exemption see the Exemption page is taxed at the following rates. 4 of taxable income for tax years beginning January 1 2017 3 of. The schedule for the phase out is as follows for the tax rate.

Tennessee Inheritance and Gift Tax. However if the value of the estate. What is the inheritance tax rate in Tennessee.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. There are NO Tennessee Inheritance Tax. The Hall Income Tax will be eliminated by 2022.

In Tennessee the median property tax rate is 685 per 100000 of assessed home value. Each state sets its own inheritance tax rates and exemptions based on the value of the estate as well as the relationship of the beneficiaries. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now.

Register a Business Online. There is a chance though that another states inheritance tax will apply if you inherit. No estate tax or inheritance tax.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. 2016 Inheritance tax completely eliminated.

Annuity Taxation How Various Annuities Are Taxed

State Tax Levels In The United States Wikiwand

Historical Rhode Island Tax Policy Information Ballotpedia

Riverside County Ca Property Tax Calculator Smartasset

Dc Tax Rates Rankings District Of Columbia Taxes Tax Foundation

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

Dc Tax Rates Rankings District Of Columbia Taxes Tax Foundation

Dc Tax Rates Rankings District Of Columbia Taxes Tax Foundation

Annuity Taxation How Various Annuities Are Taxed

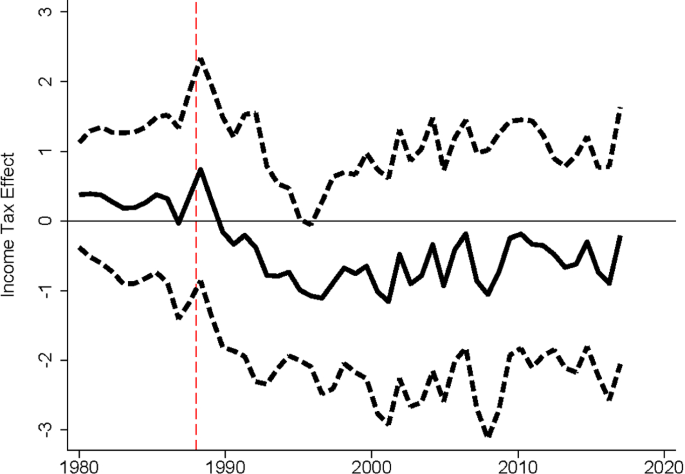

State Income Taxes And Team Performance Springerlink

Dc Tax Rates Rankings District Of Columbia Taxes Tax Foundation

Dc Tax Rates Rankings District Of Columbia Taxes Tax Foundation

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Dc Tax Rates Rankings District Of Columbia Taxes Tax Foundation

Alberta Now Has A Lower Tax Rate On The Super Rich Than The U S

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

5 Essential Steps To Reform Taxes In Nebraska

Rhode Island Income Tax Ri State Tax Calculator Community Tax